Navigating the healthcare landscape can be a complex journey, especially as we age. Medicare, the bedrock of senior healthcare in the US, provides crucial coverage, but it doesn't cover everything. This is where the question of supplemental insurance arises, and AARP, a prominent organization advocating for seniors, often enters the conversation. So, how does AARP fit into the picture with Medicare?

Let's clear up a common misconception: AARP does not function as a "secondary" insurer to Medicare in the traditional sense. Instead, AARP partners with UnitedHealthcare to offer Medicare Supplement Insurance plans, also known as Medigap policies. These plans are designed to help fill the gaps in Original Medicare coverage, such as copayments, coinsurance, and deductibles. Think of them as a safety net, helping to reduce out-of-pocket expenses.

AARP's association with Medicare supplemental insurance stems from its mission to empower seniors and ensure their access to affordable healthcare. While not directly providing the insurance itself, AARP's collaboration with a trusted insurance provider like UnitedHealthcare allows its members access to plans tailored to their needs. It's a practical approach to addressing the financial challenges that can arise with healthcare expenses in retirement.

Understanding the role of supplemental insurance is crucial for maximizing your Medicare benefits. While Medicare Part A and Part B cover a significant portion of hospital and medical expenses, respectively, there are still cost-sharing responsibilities that can add up. This is where AARP-endorsed Medigap plans can step in, providing extra coverage and peace of mind.

However, it's important to remember that Medigap plans are not the only option for supplemental coverage. Medicare Advantage (Part C) plans offer an alternative approach, bundling Medicare benefits with additional coverage, often including prescription drugs and vision or dental care. Choosing between a Medigap plan and a Medicare Advantage plan depends on individual needs and preferences.

AARP's involvement in offering Medigap plans has a rich history, aligning with their long-standing advocacy for seniors' well-being. By collaborating with UnitedHealthcare, they have facilitated access to these plans for millions of seniors, helping them navigate the complexities of healthcare coverage.

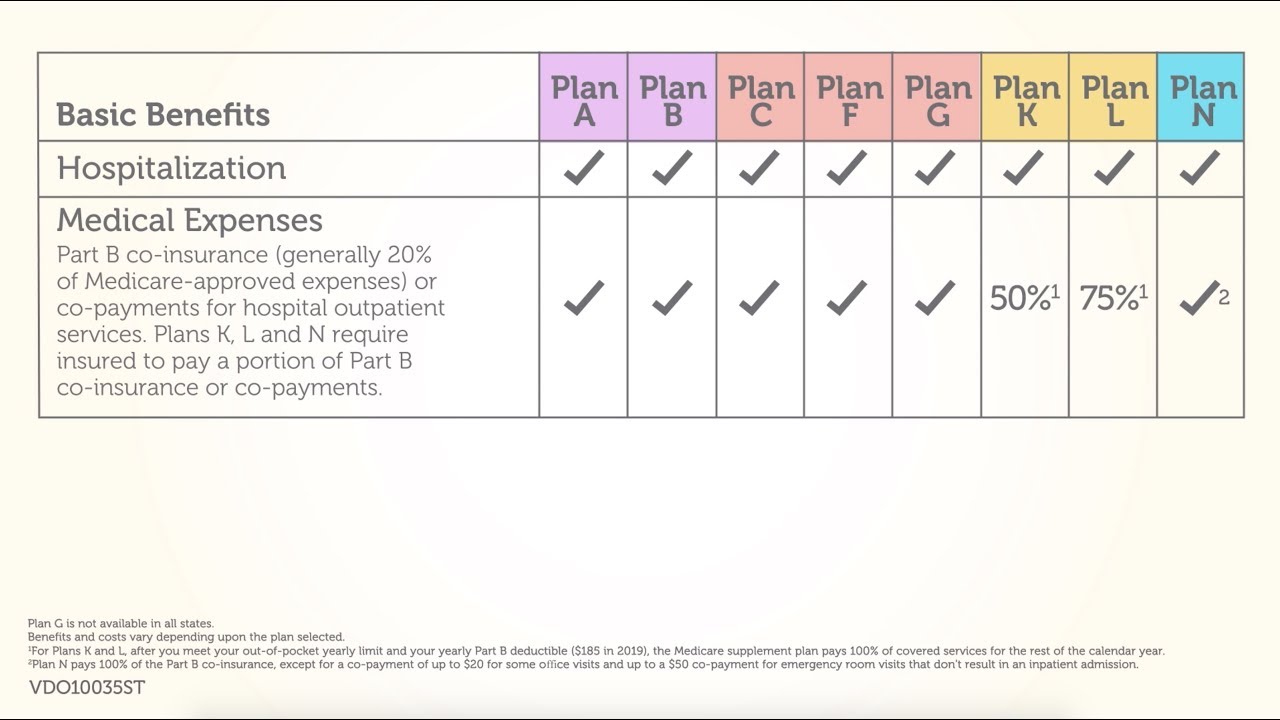

A key issue related to Medigap plans, including those offered through AARP/UnitedHealthcare, is understanding the different plan options available. These plans are standardized and labeled with letters (e.g., Plan G, Plan N). Each plan offers a different level of coverage, so it's essential to compare and choose the one that best suits your individual needs and budget.

For example, Plan G generally covers most out-of-pocket expenses, while Plan N requires copays for some doctor visits and emergency room services. Understanding these nuances is crucial for making an informed decision.

One benefit of AARP Medigap plans is their acceptance by any doctor who accepts Medicare. This provides flexibility and peace of mind, knowing you won't be limited in your choice of healthcare providers. Another advantage is the predictable costs associated with these plans, making it easier to budget for healthcare expenses. Finally, the AARP brand recognition and reputation for advocating for seniors offers a sense of trust and reliability.

Advantages and Disadvantages of AARP/UnitedHealthcare Medigap Plans

| Advantages | Disadvantages |

|---|---|

| Acceptance by Medicare providers | Can be more expensive than Medicare Advantage |

| Predictable costs | Doesn't usually cover prescription drugs (requires a separate Part D plan) |

| AARP's reputation and resources | May not be the best option if you travel extensively outside the U.S. |

Best practices include comparing different Medigap plans, considering your budget and healthcare needs, and enrolling during your Medigap Open Enrollment Period to avoid potential underwriting issues.

Choosing the right Medicare coverage can feel overwhelming. However, understanding the relationship between AARP and Medicare—recognizing that AARP offers Medigap plans to supplement Original Medicare—can empower you to make informed decisions about your healthcare future. Consult with a licensed insurance agent or visit the Medicare website for personalized guidance. By carefully evaluating your needs and exploring the available options, you can secure the coverage that best fits your lifestyle and provides financial peace of mind.

Villainous developments in i am the villain chapter 32

Heartfelt fathers day poetry a touching tribute

Unraveling the afton family tree mystery