Navigating the labyrinthine world of health insurance can feel like deciphering an ancient scroll. Deductibles, co-pays, out-of-pocket maximums – the terminology alone can be daunting. One common question echoing through the digital halls of healthcare queries: Does BCBS (Blue Cross Blue Shield) offer plans with a $150 deductible?

The short answer isn’t a simple yes or no. BCBS encompasses a network of independent companies, each offering a spectrum of plans tailored to varying needs and budgets. A $150 deductible isn't a universally available standard, but the possibility exists depending on your location and the specific BCBS company serving your area.

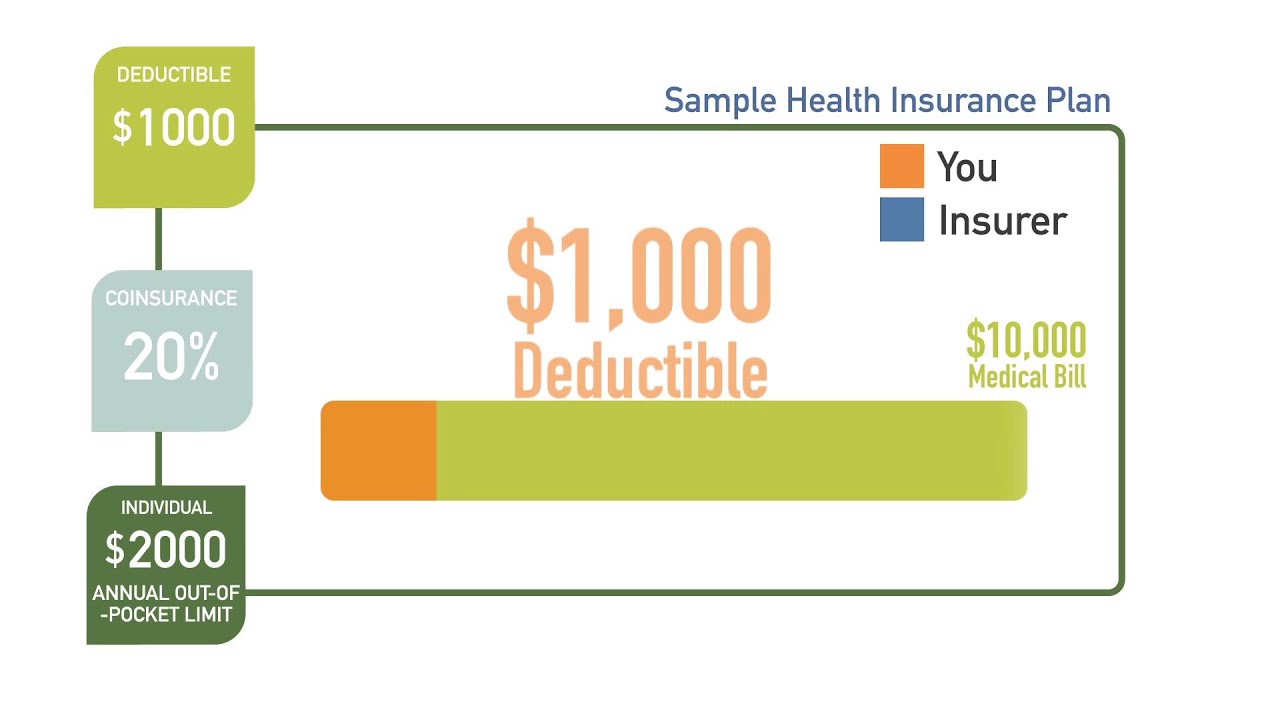

Understanding how deductibles function is crucial. A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to significantly share the costs. A lower deductible, like $150, means you'll reach your cost-sharing threshold faster, but it might come with higher monthly premiums. Conversely, a higher deductible could mean lower premiums, but you’ll pay more upfront for medical care.

Finding a BCBS plan with a $150 deductible, or any specific deductible amount, requires a bit of detective work. Directly contacting your local BCBS company is the most reliable avenue. Their website often provides plan details, or you can speak with a representative to discuss options tailored to your circumstances.

Exploring the BCBS marketplace during open enrollment or qualifying life events (like marriage or job change) offers the opportunity to compare plans and potentially uncover a $150 deductible option. Be sure to examine the fine print, scrutinizing not only the deductible but also factors like co-pays, coinsurance, and the plan's network of doctors and hospitals.

BCBS has a long history, emerging from the early 20th century, rooted in providing access to affordable healthcare. The concept of deductibles is integral to most modern insurance plans, managing costs and risk-sharing. A $150 deductible, while not universally standard across BCBS plans, represents a potentially attractive option for individuals seeking lower upfront healthcare costs.

One key issue surrounding deductibles is the potential financial burden they can impose. Even a seemingly modest $150 deductible could be challenging for some individuals, emphasizing the importance of carefully considering one's financial situation when choosing a plan.

For example, imagine you have a BCBS plan with a $150 deductible. You visit the doctor for a routine check-up costing $200. You'll pay the $150 deductible, and your insurance may cover the remaining $50 (depending on your plan's cost-sharing structure).

While a lower deductible might mean higher premiums, the advantage lies in quicker access to cost-sharing with your insurer. For instance, if you anticipate frequent doctor visits or require ongoing medication, a lower deductible might be more cost-effective in the long run.

To find a BCBS plan with a $150 deductible (or any desired amount):

1. Visit your local BCBS website and use their plan finder tool.

2. Contact a BCBS representative directly to discuss available plans.

3. Compare plans during open enrollment or a qualifying life event.Advantages and Disadvantages of a Low Deductible

| Advantages | Disadvantages |

|---|---|

| Lower upfront costs for medical services after deductible is met. | Potentially higher monthly premiums. |

| Faster access to cost-sharing with the insurance company. | May not be the most cost-effective option for individuals who rarely require medical care. |

Frequently Asked Questions:

1. Do all BCBS plans have a $150 deductible? No, deductible amounts vary by plan and location.

2. How do I find a BCBS plan with a specific deductible? Contact your local BCBS or use their online tools.

3. What factors influence deductible amounts? Plan type, coverage level, and location.

4. What are the advantages of a low deductible? Quicker cost-sharing but potentially higher premiums.

5. What are the disadvantages of a low deductible? Higher premiums, potentially less cost-effective for infrequent users.

6. How does a deductible work? You pay upfront until the deductible is met, then insurance shares costs.

7. Can I change my deductible during the year? Generally, only during open enrollment or a qualifying life event.

8. Where can I find more information about BCBS plans? Visit your local BCBS website.

Understanding your healthcare needs and budget is paramount when selecting a health insurance plan. A $150 deductible can be an appealing feature, but it's crucial to weigh the potential benefits against the associated premium costs and consider your individual healthcare utilization patterns. Researching and comparing plans, consulting with BCBS representatives, and carefully reading plan details will empower you to make informed decisions that align with your healthcare goals and financial situation. Investing time in understanding your options will ultimately lead to a more positive and cost-effective healthcare experience.

European football todays matches your complete guide

Unlocking skincare savings your guide to drunk elephant dupes

Your health hub etowah county health department in gadsden