Navigating the complexities of Medicare can be daunting, especially when trying to understand supplemental coverage. Are you seeking peace of mind regarding your healthcare expenses in retirement? This comprehensive guide will help you understand Medicare Supplement Plan A, often referred to as Medigap Plan A, a fundamental option for enhancing your Original Medicare benefits. This exploration will equip you with the knowledge you need to make informed decisions about your healthcare future.

Medicare Supplement Plan A is a standardized Medigap policy offered by private insurance companies. It's designed to fill in some of the "gaps" in Original Medicare (Part A and Part B) coverage, helping to reduce your out-of-pocket costs. These costs include things like copayments, coinsurance, and deductibles. Understanding Plan A's core benefits is crucial for maximizing your healthcare coverage and financial security during retirement.

Medigap policies, including Plan A, originated from the need to address the financial burdens associated with Original Medicare cost-sharing. As healthcare costs rose, it became increasingly important for beneficiaries to have options for protecting themselves from potentially high out-of-pocket expenses. Plan A is the most basic Medigap plan and is often considered a valuable safety net for those seeking predictable healthcare costs. Its importance lies in providing a foundation of coverage that helps individuals budget for medical expenses.

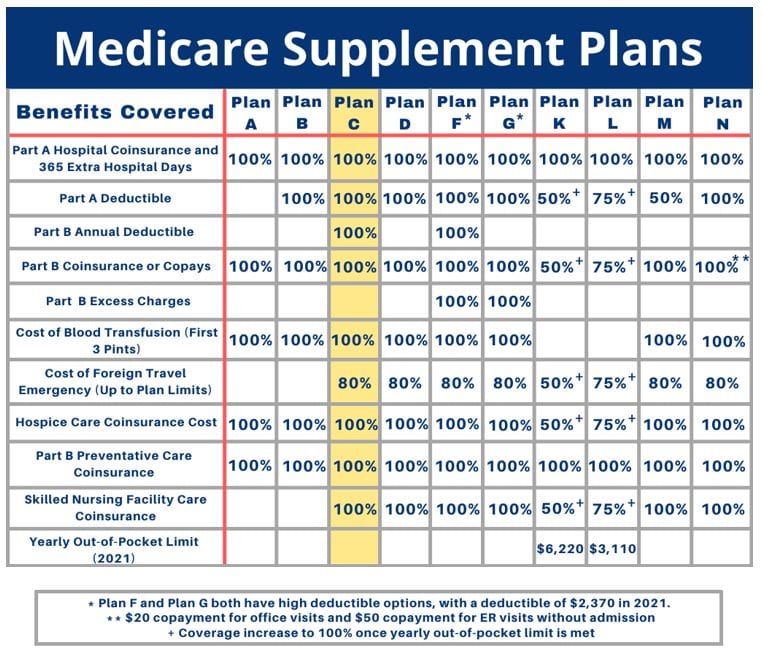

A key aspect of Medicare Supplement Plan A is its standardized benefits. This means that no matter which insurance company you choose, the Plan A benefits remain consistent. This standardization simplifies the comparison shopping process, enabling you to focus on finding the best price for identical coverage. However, one potential issue associated with Plan A is that it doesn't cover Part B excess charges. These are amounts that doctors who don’t accept Medicare assignment can charge above the approved Medicare amount.

Medicare Supplement Plan A covers several key areas. It pays for your Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are exhausted). Plan A also covers your Part B coinsurance, the first three pints of blood needed for a medical procedure, and hospice care coinsurance. Understanding these specific benefits is essential when evaluating your healthcare needs and deciding if Plan A provides sufficient coverage.

Benefits of Medicare Supplement Plan A:

1. Predictable Costs: Plan A helps stabilize your healthcare expenses by covering specific out-of-pocket costs associated with Original Medicare. For example, if you are hospitalized, Plan A will pay your Part A coinsurance, providing a predictable cost structure. 2. Simplified Healthcare Budgeting: Knowing what your out-of-pocket expenses will be makes it easier to plan your budget and avoid unexpected medical bills. 3. Nationwide Coverage: You can use your Medigap coverage anywhere in the United States where Medicare is accepted. This is particularly beneficial if you travel frequently or split your time between different locations.

Advantages and Disadvantages of Medicare Supplement Plan A

| Advantages | Disadvantages |

|---|---|

| Predictable Costs | Doesn't cover Part B excess charges |

| Standardized Benefits | May not cover all out-of-pocket expenses |

| Nationwide Coverage |

Frequently Asked Questions

1. When can I enroll in a Medigap plan? The best time to enroll is during your Medigap Open Enrollment Period. 2. How much does Plan A cost? Premiums vary depending on the insurance company and your location. 3. Can I switch Medigap plans later? You can, but you may be subject to medical underwriting. 4. Does Plan A cover prescription drugs? No, you will need a separate Part D plan for prescription drug coverage. 5. Will Plan A work with Medicare Advantage? No, Medigap plans are designed to work with Original Medicare. 6. Can my Medigap plan be canceled? Generally, as long as you pay your premiums, your plan cannot be canceled. 7. Where can I find more information about Medigap plans? You can visit Medicare.gov or contact your State Health Insurance Assistance Program (SHIP). 8. How do I compare Plan A premiums? Use online comparison tools or contact different insurance companies directly.

Tips and Tricks

Compare premiums from different insurance companies to find the best rate. Work with a licensed insurance agent who specializes in Medicare to get personalized assistance.

In conclusion, Medicare Supplement Plan A offers a foundational level of coverage to enhance Original Medicare benefits. While it may not cover all out-of-pocket expenses, particularly Part B excess charges, it provides valuable protection against many common costs associated with healthcare. By carefully considering your individual needs and budget, you can determine if Plan A is the right choice for your healthcare coverage. Understanding the core benefits, limitations, and costs associated with Plan A will empower you to make an informed decision and enjoy a more secure healthcare future. It's essential to research, compare plan options, and seek professional advice to ensure you select the coverage that best aligns with your individual circumstances. Taking the time to understand your options is a crucial step in ensuring your health and financial well-being during retirement.

Csu spring semester end dates decoded

Maximize your space 10x10 bedroom design ideas

Unlocking the charm of behr pine cone hill a comprehensive guide