Ocean City, New Jersey, a popular seaside destination, attracts homeowners and vacationers alike. But beyond the beautiful beaches and vibrant boardwalk, a crucial aspect of owning property in Ocean City is understanding the local property tax structure. This comprehensive guide will delve into the intricacies of Ocean City, NJ property taxes, providing valuable insights for current homeowners, prospective buyers, and anyone interested in understanding the financial landscape of this coastal community.

Navigating the world of property taxes can be daunting, especially in a unique location like Ocean City. The tax rate in Ocean City, NJ, directly funds essential municipal services, including public safety, education, and infrastructure maintenance. Understanding how these taxes are calculated, what they fund, and how they impact your overall investment is crucial for making informed decisions about property ownership in this beautiful seaside town.

The history of property taxation in Ocean City, like many other municipalities, is tied to the development and growth of the town. As Ocean City evolved from a small seaside settlement to a bustling resort town, the need for public services and infrastructure grew, leading to the implementation and evolution of the property tax system. Understanding this historical context can provide valuable insights into the current tax structure and its future trajectory.

Property taxes in Ocean City are calculated based on the assessed value of your property. This assessed value is determined by the city's tax assessor and may not always reflect the market value of your property. It’s important to understand how your property is assessed to ensure accuracy and fairness in your tax bill. Appealing your assessment is an option if you believe it’s inaccurate. Understanding the appeals process is an essential part of navigating the Ocean City property tax system.

One of the main issues surrounding property taxes in Ocean City, and many other resort towns, is the fluctuation of property values. Tourism, seasonal demand, and economic factors can influence these values, leading to changes in tax assessments and subsequent tax bills. Keeping abreast of these market fluctuations and understanding how they might impact your property taxes is essential for responsible financial planning.

While property taxes represent a significant expense, they contribute to the high quality of life enjoyed by residents of Ocean City. These taxes fund crucial services, such as well-maintained beaches, public safety resources, a robust education system, and infrastructure development. Understanding the connection between your tax dollars and the services they support can provide a broader perspective on the value of property taxes in Ocean City.

If you are considering buying property in Ocean City, researching recent property tax rates is a vital step. You can access this information through the city's official website or by contacting the tax assessor's office. Understanding the current tax rates and anticipating potential fluctuations can help you make informed decisions about your investment.

Advantages and Disadvantages of Ocean City, NJ Property Taxes

| Advantages | Disadvantages |

|---|---|

| Funds essential city services | Can be a significant expense |

| Contributes to high quality of life | Subject to fluctuations based on property values |

One key benefit of understanding Ocean City property taxes is being able to accurately budget for your property ownership costs. This allows you to make informed financial decisions and avoid unexpected expenses.

Another benefit is the ability to plan for potential tax increases or decreases. By staying informed about market trends and local government decisions, you can anticipate changes in your tax bill and adjust your budget accordingly.

A third benefit is being able to take advantage of any available tax deductions or exemptions. Researching these opportunities can potentially reduce your overall tax burden.

Frequently Asked Questions about Ocean City, NJ Property Taxes

What is the current property tax rate in Ocean City, NJ? (Consult the official city website or tax assessor for the most up-to-date information.)

How is my property assessed? (The city tax assessor determines assessed values based on various factors.)

How can I appeal my property tax assessment? (Contact the tax assessor’s office for information on the appeals process.)

What do my property taxes fund? (Taxes support essential services like public safety, education, and infrastructure.)

Where can I find more information about Ocean City property taxes? (The city’s official website and the tax assessor's office are valuable resources.)

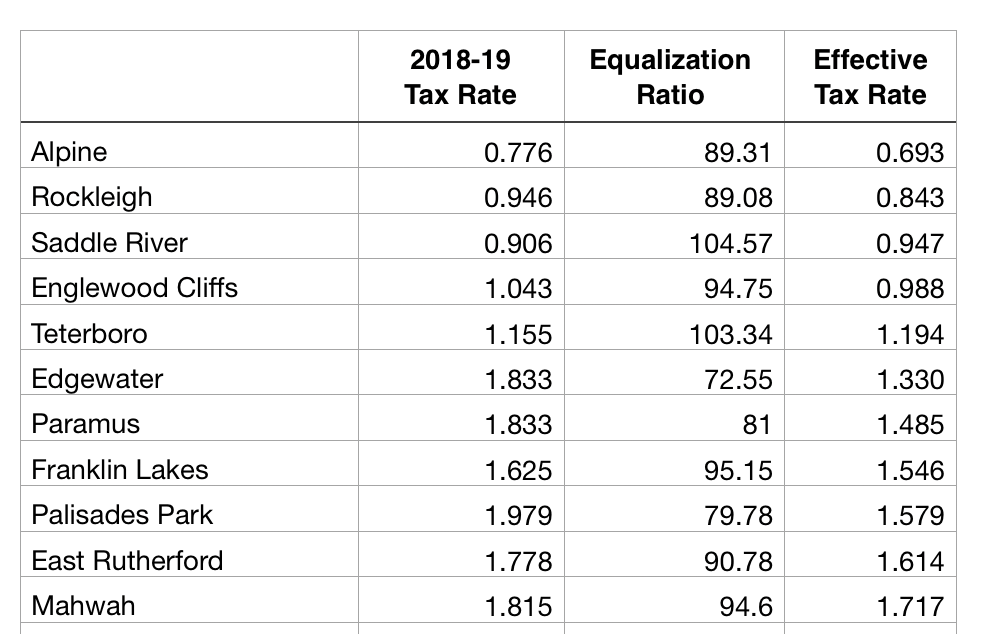

How do property taxes in Ocean City compare to other nearby towns? (Research and compare tax rates in neighboring municipalities.)

Are there any property tax deductions or exemptions available? (Research potential deductions and exemptions that may apply to your situation.)

How might future development in Ocean City impact property taxes? (Consider the potential effects of new developments on city services and tax rates.)

In conclusion, understanding the intricacies of Ocean City, NJ, property taxes is paramount for anyone involved in property ownership or considering investing in this vibrant coastal community. From the historical context to the current calculation methods, understanding how these taxes function empowers homeowners and prospective buyers to make informed financial decisions. By staying informed about tax rates, assessment procedures, and potential fluctuations, you can effectively manage your property ownership costs and contribute to the thriving community of Ocean City. Take the time to research, ask questions, and utilize available resources to gain a comprehensive understanding of this essential aspect of Ocean City living. Your proactive approach will undoubtedly benefit your financial well-being and contribute to a positive experience in this beautiful seaside town.

Unlocking local treasures birmingham facebook marketplace

Uncovering willieon yates and warren county

Walmart car battery jump starters your emergency power solution